Historical Evolution of Insurance

Historical Evolution of Insurance

Insurance, in its myriad forms, is a financial instrument that has become an integral part of modern life. It offers a safety net, a shield against the uncertainties that life inevitably presents. Whether it’s protecting your health, your home, your vehicle, or your loved ones, insurance plays a pivotal role in securing your future.

In this comprehensive article, we will delve into the world of insurance, exploring its history, the different types of insurance available, its importance in today’s world, and how you can make informed decisions when selecting insurance policies. By the end of this journey, you’ll have a deep understanding of insurance and how it can be a valuable asset in safeguarding your financial well-being.

Historical Evolution of Insurance

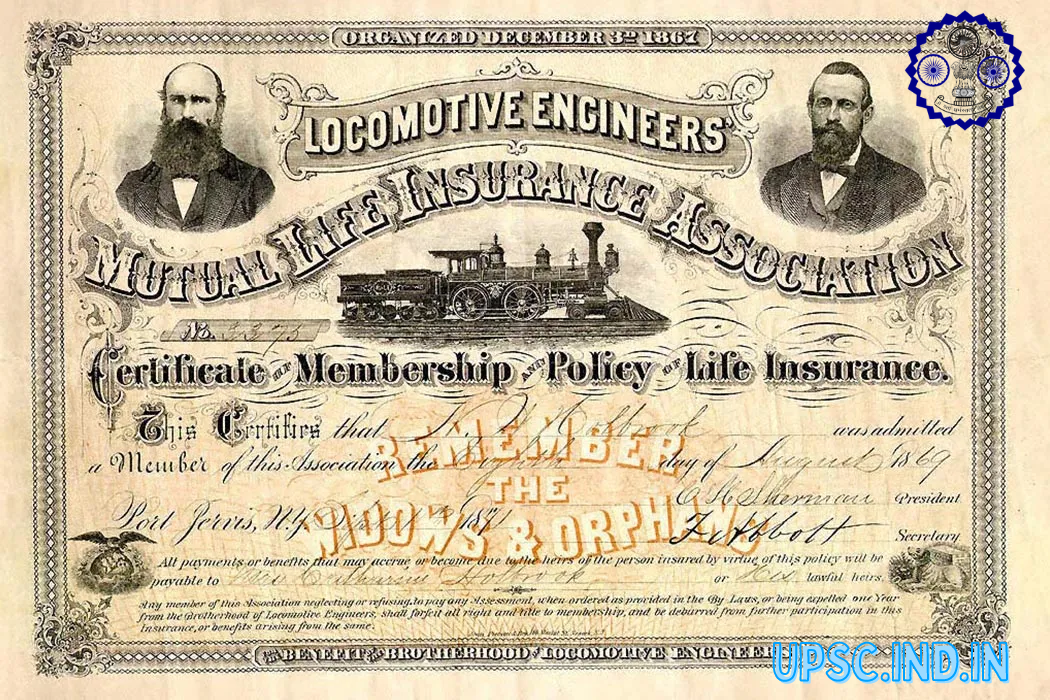

The concept of insurance dates back thousands of years, with its roots in ancient civilizations. Early forms of insurance can be traced to Babylon, where traders sought to spread the risk of losing their cargo during long, perilous journeys. These traders would pay an additional sum to lenders in exchange for protection from losses due to theft, storms, or other unforeseen events.

In ancient Rome, burial societies provided a form of life insurance. Members would contribute to a common fund, which would cover the cost of a proper burial for deceased members. This ensured that individuals and their families wouldn’t be burdened with funeral expenses during times of grief.

The modern insurance industry, however, began to take shape in the coffeehouses of London in the 17th century. Lloyd’s Coffee House, in particular, became a hub for merchants, shipowners, and underwriters. It was here that marine insurance and the concept of risk-sharing truly blossomed. Merchants and shipowners would gather to spread the risk of maritime ventures, laying the foundation for the Lloyd’s of London insurance market.

Insurance continued to evolve over the centuries, expanding beyond maritime risks to encompass life, health, property, and various other forms of protection. Today, the global insurance industry is a colossal enterprise, providing financial security to individuals, businesses, and nations.

Types of Insurance :-

Here are some of the most common types of insurance:

Life Insurance

Life insurance is designed to provide financial support to your dependents in the event of your death. There are several types of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific term, while whole life and universal life policies offer lifetime protection with a savings component.

Health Insurance

Health insurance covers medical expenses, including doctor’s visits, hospitalization, prescription drugs, and preventive care. It helps individuals and families manage the high costs of healthcare, ensuring that they can access necessary treatments without suffering severe financial setbacks.

Property Insurance

Property insurance safeguards your physical assets, such as your home and personal belongings, against damage or loss caused by perils like fire, theft, or natural disasters. It provides peace of mind and financial protection, allowing you to rebuild or replace your property when unexpected events occur.

Auto Insurance

Auto insurance is mandatory in many countries and covers your vehicle against damage, theft, or accidents. It also provides liability coverage, protecting you from financial responsibility in case you cause harm to others or their property while driving.

Liability Insurance

Liability insurance offers protection in situations where you are legally responsible for causing harm to another person or their property. This can include personal liability insurance, which covers accidents on your property, and professional liability insurance, which shields professionals like doctors and lawyers from malpractice claims.

Travel Insurance

Travel insurance is designed to minimize the financial risks associated with traveling, including trip cancellations, medical emergencies abroad, lost luggage, and more. It offers peace of mind when exploring new destinations or embarking on adventures.

- The Importance of Insurance

Insurance is more than just a financial product; it is a safety net that provides security and peace of mind. Here’s why insurance is crucial in today’s world:

3.1. Financial Security

Life is unpredictable, and unexpected events can lead to significant financial burdens. Insurance helps individuals and families mitigate these risks by providing financial support when it’s needed most. For example, life insurance ensures that your loved ones are financially taken care of in the event of your untimely death, allowing them to cover living expenses, debts, and future goals.

3.2. Risk Management

Insurance allows individuals and businesses to transfer the financial burden of risk to insurance companies. This risk management strategy ensures that when accidents, disasters, or unforeseen events occur, policyholders have a safety net in place to help them recover and rebuild.

3.3. Legal Requirements

In many cases, insurance is a legal requirement. For example, auto insurance is mandatory in most countries to protect both drivers and others on the road. Failure to carry the required insurance can result in legal consequences.

3.4. Peace of Mind

It means you don’t have to constantly worry about the financial consequences of unexpected events. Instead, you can focus on your daily life and long-term goals with confidence.

3.5. Economic Stability

Insurance also plays a vital role in the broader economy. It helps stabilize financial markets by spreading risk among a large pool of policyholders. This, in turn, encourages investment and economic growth.

- How to Choose the Right Insurance

Selecting the right insurance is a critical decision that requires careful consideration. Here are steps to help you make informed choices:

4.1. Assessing Your Needs

Begin by evaluating your specific needs. What risks do you want to protect against? Do you have dependents? Are you looking for short-term or long-term coverage? Understanding your requirements will guide you in selecting the appropriate types and amounts of insurance.

4.2. Researching Insurance Providers

Research insurance companies to assess their reputation, financial stability, and customer service. Choose a provider with a strong track record of fulfilling claims promptly and fairly.

4.3. Comparing Policies

Compare policies from multiple providers to find the one that best fits your needs and budget. Pay attention to exclusions and limitations as well.

4.4. Understanding Policy Terms and Conditions

Before purchasing insurance, Understand what is covered, what is excluded, and the circumstances under which the policy pays out. Seek clarification from the insurance provider or an insurance agent if you have questions.

4.5. Evaluating Costs

Consider the cost of insurance premiums and how they fit into your overall budget. While it’s essential to find affordable coverage, remember that opting for the cheapest policy may not provide adequate protection when you need it most. Balance cost with coverage to find the right policy.

- Insurance and Risk Management

Insurance is a key component of risk management, a broader process of identifying, assessing, and mitigating risks. Effective risk management involves:

Identifying potential risks and vulnerabilities.

Evaluating the impact of these risks on your finances and well-being.

Taking proactive measures to reduce risks where possible.

Using insurance as a safety net to protect against remaining risks.

For example, if you live in an area prone to natural disasters, you might take steps to reinforce your home’s structural integrity (risk reduction). However, you would still purchase property insurance to protect against the financial impact of severe damage (risk transfer).

- The Future of Insurance

The insurance industry is continually evolving, driven by technological advancements, changing consumer preferences, and emerging risks.

6.1. Insurtech

The integration of technology, known as “insurtech,” is transforming how insurance is bought and sold. Online platforms, mobile apps, and data analytics are making it easier for consumers to access and purchase insurance, while also enabling insurers to streamline processes and offer more personalized coverage.

6.2. Usage-Based Insurance

With the advent of telematics and IoT (Internet of Things) devices, insurers can now offer usage-based insurance policies. This means that premiums are based on how often, where, and how you use insured items, such as vehicles. This trend promotes safer behavior and can lead to more tailored coverage.

6.3. Cyber Insurance

As the digital landscape expands, so does the risk of cyberattacks. It provides protection against the financial fallout of data breaches, ransomware attacks, and other cyber threats.

6.4. Sustainability and Climate Change

The insurance industry is closely monitoring the impact of climate change and the increasing frequency of natural disasters. Insurers are adapting by offering climate-related coverage and encouraging policyholders to take steps to mitigate environmental risks.

6.5. Personalization

Advancements in data analytics allow insurers to personalize policies based on individual behavior and risk profiles. This shift from one-size-fits-all coverage to tailored insurance is empowering consumers to get the protection they truly need.

To check the website for more information

TO MORE UPDATE FOLLOW US

Conclusion

Insurance is a vital component of modern life, providing financial security and peace of mind in the face of uncertainty. It has evolved over centuries, adapting to the changing needs of individuals and businesses. Choosing the right insurance requires a thoughtful assessment of your needs, research into reputable providers, and a clear understanding of policy terms and conditions.

As the insurance industry embraces technology and adapts to emerging risks, it continues to play a pivotal role in safeguarding our financial well-being. By staying informed about insurance options and taking proactive steps to manage risks, individuals and businesses can navigate life’s uncertainties with confidence, knowing that they have a trusted partner in their corner.